Monthly Context Report - July 2023

16 Aug 2023

Cover photo: Grain cargo in Kyiv Oblast, August 2023. © Igor Mitchnik

Summary

Multiple attacks affected navigation in the Black Sea and posed the risk of disruption of global commerce. Russian air attacks against Ukraine were focused on military and security infrastructure, including command centers and the significant targeting of grain storage and port facilities. Sumy Oblast in Ukraine’s northeast recorded the highest number of explosions over the month, likely resulting from Russian reinforcement deployed across the border to prevent Ukrainian forces’ ground incursions. Ukraine was increasingly attacking Russia-controlled territories with air and sea drones.

Ukrainian authorities continue taking action to address widespread corruption and misuse of power. Several high-level government officials and MPs resigned while authorities initiated a broad investigation to check all the military mobilization centers nationwide following multiple corruption scandals. Ukraine was not invited to join NATO during Lithuania’s July 11–12 summit.

Consumer inflation decreased, while economic activity continued to pick up due to the start of the harvest season and increased construction activities. The government terminated tax benefits for small and medium enterprises and resumed state inspections. On July 17, Russia suspended its participation in the Black Sea Grain Initiative, with attacks against Odesa and Danube ports blocking around 75% of agricultural export. With this year’s harvest, Ukraine may have about 50 million tons of agricultural produce for export.

The destruction of the Kakhovka Dam left many farmers without the financial means to restart their livelihoods, while others lost household gardens and the food security and income they provided. The law on “Waste Management”, aiming to stimulate recycling by producers, entered into force, but the legal framework to enforce it is yet to be adopted.

Polish and Ukrainian presidents jointly commemorated victims of the Volhynia massacres in 1943–45, coming up with a neutral statement regarding highly contested events, affecting Polish–Ukrainian relations and fueling anti-Ukrainian sentiments among the Polish public.

The government of Moldova has decided to significantly reduce the number of Russian diplomats in the country, while an opposition leader in breakaway Transnistria willing to engage with Moldovan authorities was murdered in his apartment.

Turkey: In the lead-up to the NATO summit in Vilnius, Lithuania, which has been maintaining constructive relations with both Russia and Ukraine, voiced its support for Ukraine to join the alliance. Moreover, on July 8, Turkey returned five commanders from Ukraine’s Azov Brigade to Ukraine, who had been in Turkey after being released from Russian captivity under Erdoğan’s guarantees.

Trends to Watch

Security & Access: Russian attacks near NATO border pose an escalation threat. Although a direct confrontation is not very likely, the possibility is not negligible. The rising trend of aerial assaults between both parties suggests that Ukrainian strikes on Russian and Russian-controlled regions could continue and perhaps even intensify, accompanied by Moscow’s retaliation against crucial Ukrainian infrastructure and institutions. The deployment of Wagner troops to Belarus has raised concerns about potential provocations at Belarus’ border with E.U.

Political & Legal: Corruption in mobilization centers and officials vacationing abroad in violation of the travel restrictions could further affect social cohesion. Russia and Ukraine will likely implement stricter mobilization measures and legislation, reinforcing laws on evading conscription. Peace talks could result in improved aid actors’ access and renewed exports.

Economy & Development: A state housing mortgage program at a 7% fixed interest rate—well below the inflation—may increase demand for housing and revitalize the construction industry. Terminating tax benefits may result in more businesses avoiding taxation and employing people unofficially. Should navigation disruption in the Black Sea remain, food prices may rise globally. Additionally, Ukrainian farmers may gradually drive them out of business. Greater use of land export routes may escalate tensions between Ukraine and its neighboring countries. In the longer run, Ukraine’s role as a major food supplier may diminish.

Environment: Energy shortage and the looming possibility of renewed Russian attacks on energy infrastructure might trigger a seasonal displacement from Ukraine back to neighboring countries. There may be an increase in displacement due to the Kakhovka Dam destruction, with the affected rural populations not being able to maintain acceptable levels of food security and moving to bigger cities or neighboring countries in search of employment.

Security & Access

Assessed control of terrain in Ukraine as of August 13, 2023, 3:00 P.M. ET.

Russian-controlled Ukrainian territory before February 24, 2022, marked in black. Assessed Russian-controlled Ukrainian territory marked in red. Claimed Ukrainian counteroffensives marked in blue. © 2023 Institute for the Study of War and AEI’s Critical Threats Project

Black Sea Security

Multiple attacks affecting navigation in the Black Sea pose the risk of escalation in the broader region and disruption of global commerce. The drone attack on July 17 was already the second Ukrainian attack against the Kerch Bridge in Crimea since February 2022. The bridge connects the peninsula with Russia’s mainland and is crucial in military and civilian logistics and supply. Moscow launched “retaliation” air attacks on southern Ukraine between July 18–24. However, as many attacks targeted grain infrastructure, observers believe they could be linked to Russia suspending its participation in the Grain Deal. (An agreement reached in July 2022 to export Ukrainian agriculture products through the Odesa ports.)

These attacks primarily targeted port and agriculture infrastructure in Odesa and Mykolaiv oblasts. Apart from attacks against seaports, the Danube River port of Reni on the Romanian border was attacked for the first time since the invasion. Civilian infrastructures, including Odesa’s historical center and the Chinese Consulate General, were significantly impacted.

Map of the Black Sea

A map showing the location of the Black Sea and some of the large or prominent ports around it. The Sea of Azov and Sea of Marmara are also labelled. NormanEinstein/Wikipedia Creative Commons.

With the Grain Deal no longer in place, Russia and Ukraine threatened to disrupt each other’s safe access to ports on the Black Sea, declaring they would treat all ships traveling to ports under each other’s control as potentially carrying military cargo. Russian Ministry of Defense said on July 25 that an assault on a patrol vessel in the Black Sea was carried out by marine drones, attributing responsibility to Ukraine. Two other Russian ships were attacked near the Kerch Bridge in early August. Russia restricted navigation under the bridge, allowing daytime passage for pre-approved vessels only.

Despite Russian threats in the Black Sea, three civilian ships from Israel, Greece and a Turkish–Georgian partnership completed their voyages to Danube ports in Ukraine on July 30. The journey was safeguarded by an American anti-ship aircraft and a surveillance drone. It was followed by another Russian strike against Danube ports in early August, likely demonstrating that Moscow intends to stop the export seriously.

Source: Mercy Corps’ Crisis Analytics Team. Yemen.

Analysis & Forecasting

The security situation in the Black Sea is becoming more volatile, and it signifies a concerning trend of escalating military tensions in the region that could have widespread implications for global commerce and security, as both Russia and Ukraine, being world-leading agricultural producers, use Black Sea ports for export. Russia uses the ports to import and export oil from Kazakhstan. Russian Forces continued airstrikes targeting agricultural infrastructure may have the purpose of disrupting Ukraine’s economic stability in violation of international humanitarian law. Russian attacks near NATO border pose an additional threat. Although a direct confrontation is not very likely, the possibility is not negligible.

Air Attacks

Throughout July, Russia launched a series of air attacks on various regions across Ukraine. The overarching trend is focused on military and security infrastructure and the significant targeting of grain storage and port facilities. Humanitarian infrastructure was targeted repeatedly, with the most notable incident on July 9, when Russia attacked a humanitarian aid delivery point in Orikhiv town, Zaporizhzhia Oblast, with guided aerial bombs, leading to seven deaths and eleven injuries.

Odesa Oblast experienced almost twice as many attacks as in June, while Sumy Oblast had the highest number of explosions recorded in the country in July. A mass drone assault on the S.B.U. headquarters in Sumy on July 3 resulted in an organized evacuation from the border area of the region. While the situation in Odesa Oblast is linked to Russian attacks against agricultural export infrastructure, the increased number of attacks in Sumy Oblast is likely linked to previous ground cross-border attacks in Russian neighboring Belgorod Oblast in May and June. Following those incursions from Ukraine, Russia reportedly relocated additional troops to Belgorod Oblast.

Russian-controlled Crimea and the cities of Moscow and Taganrog were attacked with U.A.V.s. The strikes targeted infrastructure, including energy, civilian objects and business centers in Moscow-City.

Analysis & Forecasting

Overall, the primary trends indicate a shift from wide-ranging, mixed targets to more focused attacks on port and agricultural infrastructure and command centers. The leading escalation indicators were the explosions on the Crimea Bridge and Grain Deal termination.

The rising trend of aerial assaults between both parties suggests that Ukrainian strikes on Russian and Russian-controlled regions could continue and perhaps even intensify, accompanied by Moscow’s retaliation against crucial Ukrainian infrastructure and institutions.

Russian Internal Military Clean-Up & Wagner Troops in Belarus

Following the failed Wagner mutiny on June 24, which met almost no resistance from the Russian army, several high-ranking Russian commanders, including General Ivan Popov and Major General Vladimir Seliverstov, were dismissed in July amid disputes over the handling of the Russian campaign in Ukraine.

Additionally, General Sergey Surovikin, former commander of Russia’s forces in Ukraine, has been conspicuously absent since the Wagner mutiny, fueling speculation about his whereabouts. Simultaneously, several prominent Russian pro-war bloggers critical of the ineffectiveness of Russian military leadership were reportedly forced to reduce their activity. Russian authorities arrested the prominent critic of the army leadership Igor Girkin (a.k.a. Strelkov). Girkin is a nationalist and reportedly a former Federal Security Service (F.S.B.) officer who led the 2014 anti-Ukrainian rebellion in Donbas and was charged with war crimes by the court in the Netherlands.

Wagner’s leader Yevgeny Prigozhin and other group commanders met Vladimir Putin in the days following the mutiny. According to Putin, they refused to join the Russian army and build up their presence in Belarus. The current number of Wagner mercenaries in Belarus is estimated at between 3,450 and 3,650.

Analysis & Forecasting

Observers believe that by getting rid of critics and preparing for new waves of mobilization, Moscow may prepare for prolonged conflict using the “human waves” tactics, which involves soldiers conducting direct attacks in large numbers to overwhelm an opposing force. On top of that, Russia has doubled its 2023 defense spending plan.

The deployment of Wagner troops to Belarus, which many believe is happening with the Kremlin’s blessing, has raised concerns regarding the possibility of a new invasion of Ukraine from the north or, more likely, potential provocations at Belarus’ border with Poland or Lithuania.

Politics & Governance

Public Pressure over Public Spending

Following the latest wave of criticism, the Ukrainian government took new action to tackle corruption and questionable public spending. President Volodymyr Zelenskyi appealed to all local authorities on July 20, emphasizing the importance of using budget resources fairly and prioritizing projects that “contribute to achieving victory.” He also encouraged sourcing private funds for less important projects and initiatives, such as film productions and museums.

The head of the ruling Servant of the People party said that the parliament might introduce legislative restrictions during martial law if such practices continue. The Minister of Culture and Information Policy of Ukraine resigned on July 21 following criticism over his proposed allocations for the National Memorial Museum of Holodomor ($15.5 million) and a T.V. series production ($12 million). On July 20, the mayor of Lviv imposed restrictions on non-priority budget expenditures during martial law to ensure that critical sectors, such as national security and defense, infrastructure, healthcare and social services, receive adequate funding.

Corruption in Military Draft

The head of the Odesa Oblast military mobilization center got arrested on corruption charges on July 24, following a media investigation, according to which he accepted bribes for mobilization exemption certificates. Ukrainian authorities initiated a broad investigation to check all the military mobilization centers across the country. A mobilization center in Bilhorod-Dnistrovskyi, Odesa Oblast, allegedly provided fake documents for $7,000–$10,00, allowing men to leave Ukraine. The head of another mobilization center in Yuzhne town, Odesa Oblast, was reportedly sent to the frontline in response to media reports of him illegally earning “millions”. The head of the Rivne Oblast mobilization center got arrested for power abuse. The head of the Donetsk Oblast mobilization center got arrested for assistance in illicit enrichment. The Ministry of Defense proposed appointing war veterans as mobilization center heads to tackle the widespread fraud.

The general mobilization was announced on March 3, 2022, for men aged 18 to 60. In May 2023 Ukrainian Minister of Defense said authorities plan to mobilize one million people. As of July 2022, the Minister reported that up to 700,000 people had been mustered into the Armed Forces of Ukraine ranks, up to 60,000 to the border guards ranks, up to 90,000 to the National Guards, and up to 100,000 National Police. In general, the mobilization reserves of Ukraine are estimated at 5.5 million people.

Media reported several M.P.s traveled abroad despite the restrictions. Yurii Aristov, a ruling party M.P., is now under investigation after vacationing in the Maldives with his family. Another M.P., Andrii Kholodov, resigned after a scandal exposed his residing in Cyprus since January 2023.

Analysis & Forecasting

The Ukrainian government is under significant public pressure due to questionable public spending, corruption and the lavish lifestyle of government officials amid an ongoing war. These challenge public trust and confidence in the government and may result in growing societal and elite tensions. The warning from the head of the ruling political party about potential legislative restrictions during martial law reflects growing government concern about the impact of these financial practices on national security, stability, and social cohesion.

According to recent independent research, public opinion toward the travel restrictions imposed on approximately 9.5 million civilian men aged 18 to 60 is divided, with only 43% supporting the restrictions. Among those less likely to support the travel restrictions are younger Ukrainians, those living in front-line areas, very poor or very wealthy, and those either without college degrees or with advanced degrees. Travel restrictions are another source of pressure on men who are already more likely to be killed or injured in the hostilities. According to OHCHR, men make up 61% of all civilian adult casualties. Corruption and abuse of power by military mobilization centers may affect social cohesion even further.

NATO Summit in Vilnius

Despite high expectations, Ukraine was not invited to join the alliance during the July 11–12 NATO summit in Vilnius, Lithuania. Although NATO confirmed its desire to accept Ukraine at some point, no precise timeline was provided. However, member states agreed to simplify the procedure for Ukraine by removing the requirement of completing a Membership Action Plan (MAP)—a multi-year program to facilitate an applicant country’s transition to NATO standards.

A NATO–Ukraine Council was set up and had its first emergency meeting on July 26, following Russian withdrawal from the Grain Deal and a series of attacks against Ukrainian ports at the border with NATO member Romania. The Council members highlighted their readiness “to contribute to the establishment of alternative ways of ensuring the export of Ukrainian grain” and to step up surveillance in the Black Sea region, including maritime patrol aircraft and drones.

Meanwhile, G7 countries signed a joint declaration promising to work with Ukraine to help guarantee its security through financial and material military support without mobilizing their troops on the ground.

Analysis & Forecasting

The summit exposed growing frustration between Kyiv and some of its Western allies. Zelenskyi expressed his disappointment that NATO was not ready to accept Ukraine.

Observers believe the decision not to grant the membership is dictated by the ongoing armed conflict in Ukraine that would drag the alliance into a war with Russia and that Ukraine still needs to address multiple internal challenges, including corruption.

The stalled accession process and Zelenskyi’s remark on potential negotiations with Russia reminded some of the peace plan proposed by Kyiv in March 2022 in Istanbul. It included Ukraine’s neutral status and bilateral security guarantees by third countries. Peace talks, such as the August peace summit in Saudi Arabia, could affect aid work in Ukraine and should be closely monitored.

Economy & Development

Inflation

Consumer inflation continued to decrease in annual terms from 15.3% in May to 12.8% in June. Month-on-month, prices rose by 0.8%, according to the State Statistics Service of Ukraine. The vegetable prices growth has slowed down, mainly due to the supply increase due to the summer season. Given the favorable dynamics of the year’s first half, the National Bank of Ukraine (N.B.U.) has significantly improved its inflation forecast for this year—from 14.8% to 10.6%. However, businesses plan to raise prices due to rising electricity and fuel costs.

According to the N.B.U.’s July report, in June, economic activity continued to pick up seasonally due to the start of the harvest season and an increase in construction activities, especially in housing and infrastructure reconstruction. It, in turn, boosted the sales of construction materials and finished metal products. The foreign exchange market remained stable, with the cash exchange rate fluctuating close to the official rate.

Source: State Statistics Service of Ukraine

Business Climate

On July 26, President Zelenskyi signed a bill terminating tax benefits for small and medium enterprises (S.M.E.s) and resumed state inspections and giving fines from August. Many S.M.E.s survived due to tax relief, so this decision may leave many firms struggling. Over 25,000 signed a petition against the bill.

Some companies reduced their capacity due to a lack of water supply due to the destruction of the Kakhovka Dam in June. The rising electricity bills will heavily affect large industrial enterprises, especially steelmakers. As a significant city-forming enterprise, the Nikopol Ferroalloy Plant is at risk of shutting down. It would negatively impact Nikopol’s budget as it contributes up to 40% of the city’s revenue.

Starting from August 1, Ukrainians who do not own a home will be able to use the state mortgage program eOselia at a 7% fixed interest rate—well below the current inflation rate.

Analysis & Forecasting

Termination of tax benefits may result in more businesses avoiding taxation, employing people unofficially and fueling the informal economy while trust in the government decreases.

With the availability of a low-interest state mortgage program, there is likely to be a surge in demand for housing among Ukrainians who previously could not afford it. This increased demand will likely revitalize the construction industry, which the war has heavily hit. Increased construction activity creates jobs and stimulates economic growth in related sectors, such as manufacturing and services. Constraints include a labor shortage, especially qualified specialists, as military mobilization has intensified in recent months.

Nationalization of Sense Bank

On July 22, the Ukrainian government completed the nationalization of Sense Bank (formerly known as Alfa-Bank) from sanctioned Russian stakeholders and appointed a new supervisory board and management team. The move aims to reduce Russia’s influence on Ukraine’s economy and to prevent the fraudulent withdrawal of large amounts of banking assets from the country to Russian owners, potentially leading to bankruptcy.

Analysis & Forecasting

Sense Bank is one of Ukraine’s systemically important banks, with 132 branches nationwide, employing about 4,000 people. The bank serves 3 million individual clients, 58,000 legal entities and 86,000 individual entrepreneurs. It is critical to the functioning of the economy and the livelihoods of Ukrainians. Previous examples of banks’ nationalization in Ukraine, such as Privatbank in 2016, demonstrated that the government could generally ensure their usual functionality.

Termination of the Grain Deal

On Monday, July 17, Russia suspended its participation in the Black Sea Grain Initiative just a few days before its first anniversary. Despite several extensions, shipments decreased, with only 1.3 million tons exported in May and no new vessels registered since the end of June. The market has already priced Russia’s exit—the Chicago Wheat Futures, a global price barometer, dropped over 1% during the day.

Yet this time, Ukraine could not continue the export without Russian approval, like in the fall of 2022, when Russia suspended its participation for the first time. Following the suspension, multiple attacks against the main export routes of Ukrainian agricultural products following the suspension affected prices globally. Wheat futures rose 9% on July 19—the most significant jump since 2012—following the attacks on Odesa port’s grain terminal and other agricultural infrastructure. Wheat futures rose to a five-month high the next day after the July 24 attacks against the Danube River port of Reni.

On August 2, Russia attacked another Danube port of Ismail. Danube ports were not a subject of Russian blockade and recently accounted for around one-quarter of all the agriculture export. They reportedly have the potential to double their capacity.

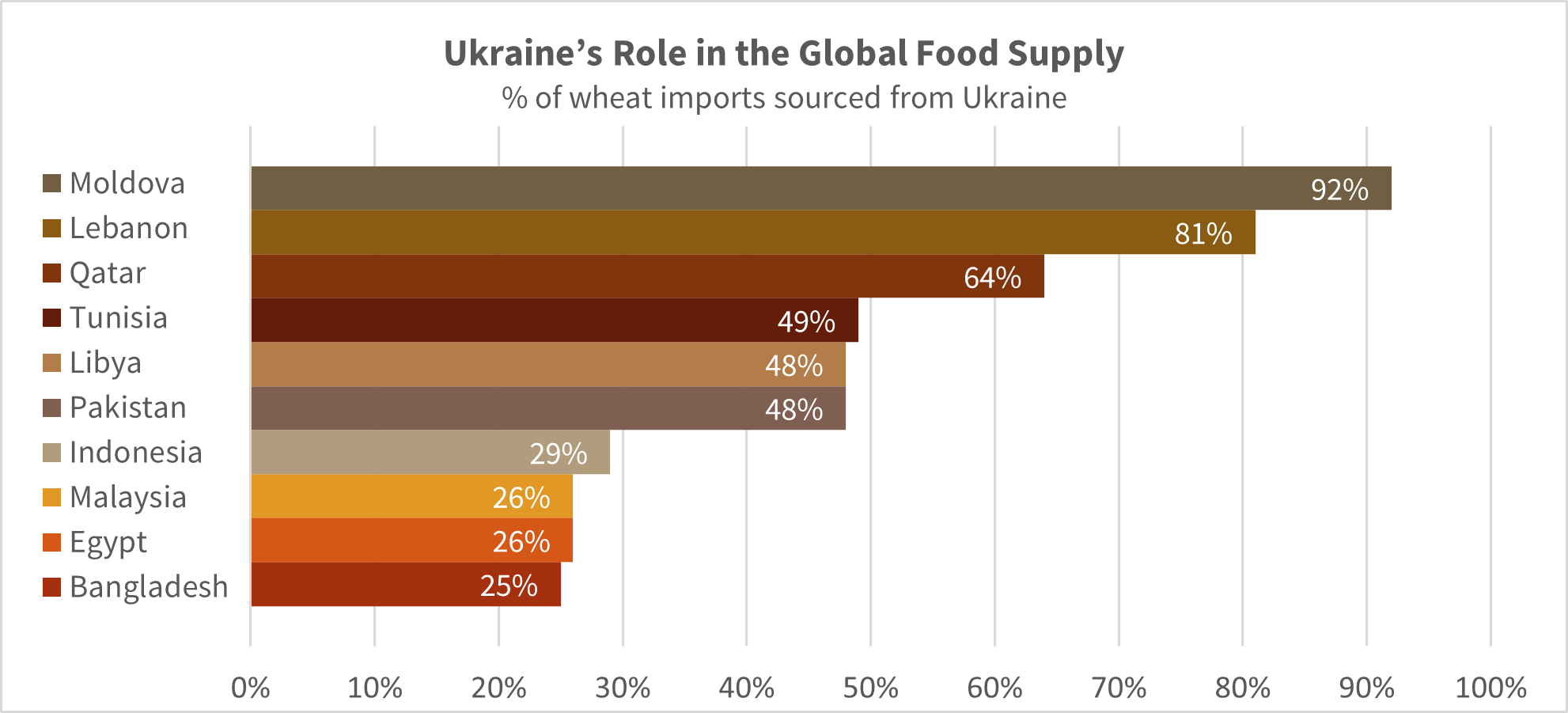

Source: UN Food and Agriculture Organization, data for 2020/BBC.

Analysis & Forecasting

As of July 1, Ukraine had 20 million tons of carryover agricultural products, and potentially another 30 million tons could be added with the July–August harvest. Many small and medium farmers operating from harvest to harvest cannot invest in the new planting season and guarantee their livelihoods without selling this year’s harvest. Should this situation remain, additional displacement of rural populations who lost their livelihoods is possible.

The expensive alternative export routes, such as rail and river ports through Europe, will lead Ukrainian farmers to reduce prices further, discourage further planting and gradually drive them out of business. Additionally, greater use of these routes may escalate tensions between Ukraine and its neighboring countries, where their local produce competes with Ukrainian food exports for storage, railcars, port facilities, and barges. In the longer run, Ukraine’s role as a major food supplier may diminish. As such, aid organizations need to prepare for a rise in food prices globally.

Environmental Trends

Aftermath of the Kakhovka Dam Explosion

The destruction of the Kakhovka Dam continues to affect local livelihoods, especially in rural areas and can result in additional displacement. Much of the region’s agricultural infrastructure, including irrigation systems, was obliterated. Topsoil washed away along with agricultural equipment and inputs. Crops and livestock were lost. Farmers have been left without the financial means to restart their livelihoods, while others lost household gardens and the food security and income they provided.

The dam’s destruction also resulted in the near-total desiccation of the Kakhovka Reservoir. In addition to providing drinking water to towns and cities in Kherson, Zaporizhzhia and Dnipropetrovsk oblasts, the reservoir provided irrigation water to thousands of square kilometers of land. The drying of the reservoir also uncovered the heavily polluted bed of the Kakhovka Reservoir. The newly exposed, largely toxic sand threatens agricultural production as strong winds could carry it long distances.

Analysis & Forecasting

The coming weeks and months will see Ukraine continue struggling with the aftermath of the Kakhovka Dam destruction and subsequent desiccation of the Kakhovka Reservoir. Ukraine will continue to require support in providing drinking water to those who lost it, while fields in Dnipropetrovsk, Zaporizhzhia and Kherson oblasts will not be sown. There is a danger that food security concerns in those oblasts, whether tied to the environmental catastrophe of the Kakhovka Dam destruction, the collapse of the Grain Deal, or both, could rise among populations that previously maintained an acceptable level of food security through their private gardens. It could lead to an increase in displacement due to environmental destruction caused by the war, with the affected rural populations moving to bigger cities in search of employment or to neighboring countries.

As the cold season approaches, there are concerns about the Ukrainian energy system expecting an energy shortage and the looming possibility of renewed Russian attacks on energy infrastructure, which might trigger a seasonal displacement from Ukraine back to neighboring countries as of October. It remains particularly likely for the key E.U. host countries—Poland and Germany.

Neighboring Countries

Poland

According to many Polish and Western historians, between 50,000 and 100,000 ethnic Poles were killed in Volhynia and Eastern Galicia—at the time, parts of Soviet-occupied Poland—in an ethnic cleansing campaign planned and carried out by Ukrainian nationalists, namely, the Organization of Ukrainian Nationalists—Bandera faction (OUN-B) and the Ukrainian Partisan Army (UPA), from 1943 to 1945, claiming this was a response to Warsaw’s interwar politics of Polonization, that forced dozens of thousands of Ukrainians to leave and changed the regions’ ethnic balance. Thousands of ethnic Ukrainians were killed in Polish retaliatory campaigns. The estimated number varies from 2,000 to 30,000.

On July 9, ahead of the NATO summit in Vilnius, Polish and Ukrainian Presidents Andrzej Duda and Volodymyr Zelenskyi met in Lutsk, the capital of Volyn Oblast in Ukraine, to commemorate the victims of the 1943–1945 massacres in Volhynia (Volyn) on the day of 80th anniversary of this event. The events are highly contested in both countries, as Poland sees them as planned “genocide” against ethnic Poles, while Ukraine tends to view them as uncoordinated actions of partisan groups, followed by retaliations against ethnic Ukrainians.

On July 11, the Polish Sejm unanimously adopted a resolution referring to the massacres as a genocide and calling for a Polish–Ukrainian reconciliation, which includes recognition of guilt and commemoration of the victims. For the first time, Polish media offered reasonably comprehensive coverage of Ukrainian perspectives on the events. However, the topic remains sensitive. In their joint statement, two presidents paid tribute to “all the innocent victims of Volhynia” without mentioning the perpetrators.

Analysis & Forecasting

Volhynia massacres have been a major topic, poisoning Polish–Ukrainian relations and fueling anti-Ukrainian sentiments among Polish public. With the full-scale Russian invasion and Poland providing vital support to Ukraine, Warsaw and Kyiv acknowledge they need to address the issue. It is essential before the fall elections in Poland amid the increasing popularity of far-right parties. At the same time, the figure of Bandera has gained much more importance in Ukraine as the country resists Russian invasion, and it would be very hard for any Ukrainian politician to condemn his actions. There is a cross-political consensus in Poland that Ukrainian authorities and society need to recognize Ukraine’s responsibility and Poland’s victim status in this historical event. President Zelenskyi and the Ukrainian ambassador to Poland, Vasyl Zvarych, were criticized for failing to acknowledge Poland’s victim status in the Volhynia killings explicitly. Yet, a more nuanced consensus has emerged since the beginning of the full-scale Russian invasion to help maintain Polish–Ukrainian alliance and partnership.

Moldova

Transnistrian Opposition Leader Found Dead

On July 16, Oleg Khorzhan, leader of the opposition Communist Party in Transnistria, was found dead in his apartment in what local police call a robbery-motivated murder. He was imprisoned in 2018 for holding an “unsanctioned” rally in the capital Tiraspol. He was released less than a year ago. Since his release, he resumed harsh criticism of the current de facto government and the oligarch Victor Gușan, the head of the Sheriff holding company. Sheriff controls many businesses in Transnistria and T.V. and radio channels.

Khorzhan spoke in favor of the continued presence of Russian troops in Transnistria. Yet, unlike other politicians in Transnistria, he believed the breakaway region could be reintegrated with Moldova, provided the authorities in Chișinău pursued pro-Russia policies. He had coordinated with other pro-Russian parties in Moldova to that end. Moldovan authorities have called for an independent investigation into Khorzhan’s death overseen by the O.S.C.E., which has called for a “thorough and transparent investigation into his death.”

Moldova to Reduce the Number of Russian Diplomats in the Country

The government of Moldova has decided to reduce the number of Russian diplomats in the country significantly. The move was attributed to alleged Russian attempts to destabilize the country.

Analysis & Forecasting

The murder of Oleg Khorzhan in Transnistria could suggest an increased intolerance of dissent. The fact that Khorzhan was more willing to engage with Moldovan authorities and Moldova’s call for an independent investigation could both point to an increasingly contentious dynamic between Chișinău and Tiraspol. It happens alongside increasing confrontation between Chișinău and Moscow, which has supported separatist Transnistria for over 30 years.

Turkey

In the lead-up to the NATO summit, Turkey voiced its support for Ukraine to join the alliance. Moreover, on July 8, Turkey returned five commanders from Ukraine’s Azov Brigade to Ukraine, who had been in Russian captivity after the battle of Mariupol. The fighters were ordered to surrender to Russian forces in May 2022 after holding out for over two months defending the Azovstal steel plant in Mariupol. Moscow accused Turkey of violating the 2022 prisoner-exchange agreement, according to which all five commanders should remain in Turkey until the war’s end.

Turkey remains relatively neutral in the Ukrainian conflict, maintaining beneficial relations with both countries. Ankara has criticized Russia’s annexation of Crimea and Russian territorial claims in east Ukraine since 2014. The Ukrainian army has used the Turkish-designed Bayraktar TB2 unmanned aerial vehicle since October 2021. Turkey provides the Russian government with an opportunity to evade Western sanctions. Russia is currently the biggest importer from Turkey, with imports totaling about $3.77 billion. Turkish exports to Russia have increased by 83% from January to April 2023. Furthermore, Turkey and Russia have been improving their energy dependency for years. In 2022, Ankara received about 39% of its natural gas and more than a third of its petroleum and oil product imports from Russia. Russia’s state nuclear energy company Rosatom is setting up Turkey’s first nuclear power plant, Akkuyu. The plant will generate about 10% of Turkey’s power by 2026.

Overall, the Turkish trade volume with Russia doubled to more than $68 billion in 2022 from almost $35 billion in 2021, with imports from Russia accounting for a significant share.

Analysis & Forecasting

Being a NATO member and maintaining good relations with Ukraine and Russia positions, Turkey will likely continue its multivector diplomacy, benefiting economically from its political and economic partnership with Russia while reaping the benefits of security cooperation and economic ties with the U.S. and the E.U. This positioning has allowed Turkey to advocate and mediate the Black Sea Grain Deal until its cancellation on July 17. Committed to facilitating the extension of the agreement, President Erdoğan actively maintains communication channels with President Putin.

After winning the presidential elections in May, President Erdoğan likely feels more secure about renegotiating the deal, as the previous one brought limited advantages to all involved parties as it went on. Although Ankara supports Ukraine symbolically, it will likely remain dependent on its economic relations with Russia. Turkish economy suffers from staggering inflation and the impact of earthquakes that killed more than 50,000 people.