Monthly Context Report - November 2023

18 Dec 2023

Photo credit: State Border Guard Service of Ukraine

Summary

Security & Access: Throughout the month of November, there were no notable changes along the front line. Ukraine’s summer/autumn counteroffensive is likely over. Heavy fighting continued around Avdiivka city (Donetsk Oblast) and the village of Robotyne (Zaporizhzhia Oblast). Ukrainian troops reportedly expanded their presence in the vicinity of Krynky village on the Russian-controlled left bank of the Dnipro River.

Political & Legal: The European Commission recommended that the EU begin accession negotiations with Ukraine, acknowledging that the country has carried out 90% of the reforms requested. Despite the progress that has been made, more steps need to be taken in the areas of corruption, de-oligarchization, and minority rights. Following this recommendation, EU leaders may initiate accession talks with Ukraine and Moldova during the upcoming European Council summit in mid-December.

Economic & Development: Despite GDP growth of 10.5% driven by high agricultural yields, a stable energy sector, and a functional trade corridor to Odesa ports, challenges such as infrastructure damage, security risks, budget deficits, and unemployment persist. The ongoing border blockade by Polish carriers is disrupting trade and generating losses for Ukrainian companies.

Humanitarian & Environmental: Due to severe weather conditions and ongoing hostilities, Ukraine’s energy system is operating at maximum capacity. This situation has its origin in Russia’s attacks on the country’s energy facilities last winter. In anticipation of another challenging winter, Ukraine has worked hard to fortify its energy infrastructure in order to mitigate potential attacks.

New legislation, effective as of December 1, imposes a much stricter regime for humanitarian aid imports. Designed to combat aid diversion, the law requires electronic declarations along with the submission of reports on how the aid was allocated.

Poland: November saw significant disruptions at Polish–Ukrainian border crossings due to blockades by Polish lorry drivers and farmers who are protesting legislation that allows Ukrainian companies to make unlimited trips through Poland. Unions from Poland, the Czech Republic, Hungary, Slovakia, and Lithuania are jointly seeking an amendment to the hauling agreement, emphasizing that their demands are driven by a desire for a balanced market rather than anti-Ukrainian sentiment.

Moldova: The European Commission recommended opening EU accession negotiations with Moldova, although Chișinău needs to continue its judicial reforms and de-oligarchization. President Sandu announced that Moldova will, if necessary, begin the process of EU integration without the breakaway region of Transnistria.

Trends to Watch

Security & Access: As winter comes on, there will likely be few significant changes to the front line, with a so-called stalemate as the most realistic scenario. The intensity of hostilities and the locations of hotspots, however, may fluctuate due to winter weather conditions.

Political & Legal: Although it took less than two years following Ukraine’s initial application, the European Commission’s recommendation for the country’s accession to the EU is likely just the start of a long negotiation process with multiple factors influencing Ukraine’s candidature.

Economic & Development: The ongoing transport blockades along Ukraine’s borders are expected to have a lasting impact on prices, further contributing to inflation. The Black Sea corridor is expected to retain its central role in facilitating international trade and supporting economic activity. To protect the corridor Ukraine will be given warships, which may, however, increase the risk of Russian attacks against these vessels and further jeopardize the security of commercial shipping.

Humanitarian & Environmental: Ukrainian NGOs and aid groups are concerned that new import procedures could complicate aid imports, introduce unnecessary bureaucracy, fail to curb corruption, and delay humanitarian aid reaching frontline regions.

Recent attacks on Ukraine’s critical infrastructure suggest the start of a broader winter offensive by Russia, potentially exploiting existing weaknesses in the country’s energy grid, leading to widespread and lengthy power outages. Despite robust protection measures, Russia's arsenal of missiles poses a significant threat, which recent attacks on frontline thermal power plants have underscored.

Poland: Lorry drivers’ demands highlight the need for policy adjustments to ensure fair competition in the transport sector. However, aligning these with EU standards while maintaining relations with Ukraine will be complex. The new Polish government will have to carefully consider farmers’ grievances over grain prices and imports and balance domestic needs with EU commitments. The outgoing government’s last-minute concessions may complicate the incoming administration’s budgetary planning.

Moldova: If Moldova can follow the “Cyprus model” and join the EU without full territorial control, this may allow it to focus on critical issues such as judicial reform, corruption and de-oligarchization, areas that the EU wants to see addressed. In contrast to Ukraine, Moldova’s small population and economy likely make its accession to the EU appealing to more risk-averse Member States.

Security & Access

The Ukrainian Front: A Winter Stalemate?

Throughout the month of November, there were no notable changes along the Ukrainian front lines. Ukraine’s summer/autumn counteroffensive is likely over, and the word “stalemate” is increasingly being used to describe the overall situation. In an article for The Economist, Valery Zaluzhny, Commander-in-Chief of the Armed Forces of Ukraine, spoke of the war entering a new phase: “what we in the military call ‘positional’ warfare of static and attritional fighting, as in the First World War, in contrast to the ‘manoeuvre’ warfare of movement and speed.”

Heavy fighting continued around Avdiivka city (Donetsk Oblast) as well as the village of Robotyne (Zaporizhzhia Oblast). Ukrainian troops reportedly expanded their presence near the village of Krynky on the Russian-controlled left bank of the Dnipro River.

The ongoing hostilities are taking a significant toll on frontline communities and restricting humanitarian access. In Avdiivka, there have been at least 157 civilian deaths since the beginning of the full-scale invasion. More than 300 people were evacuated in October/November, and fewer than 1,300 remain. The town of Pokrovsk (also in Donetsk Oblast), which once served as a logistical base for many humanitarian initiatives, came under heavy attack by Russian troops four times in November.

Analysis & Forecasting

As winter comes on, it is unlikely that the front line will shift significantly, with a so-called stalemate as the most realistic scenario. The intensity of hostilities and the locations of hotspots, however, may fluctuate due to winter weather conditions.

Ukrainian incursions into the Russian-controlled areas of Kherson Oblast on the opposite bank of the Dnipro are unlikely to deliver notable gains. However, stepped-up Russian attacks around Avdiivka and Bakhmut may potentially complicate the situation for Ukrainian forces.

Throughout November, various voices, military experts among them, called for Ukraine to halt its counteroffensive and return to a position of strategic defense. Such messages should be understood, however, against the wider backdrop of Zelenskyi’s remarks on December 1: “We wanted faster results. From that perspective, unfortunately, we did not achieve the desired results. And this is a fact.” Some observers say that, among other reasons, the Ukrainian offensive did not go according to plan because of dense Russian minefields, heavy shelling and significant losses of both people and equipment.

Political & Legal Updates

Ukraine’s Accession Prospects

In early November, the European Commission recommended that the EU begin accession negotiations with Ukraine. On November 6, following a visit to Kyiv, European Commission President Ursula von der Leyen stated that Ukraine had carried out 90% of the reforms requested. Although Ukraine has met four of the seven pre-conditions for fully initiating negotiations, more steps need to be taken in the areas of corruption, de-oligarchization, and minority rights.

Following this recommendation, EU leaders may open Ukraine and Moldova's accession talks during the upcoming European Council summit in mid-December. This decision requires the unanimous approval of all 27 Member States.

A November survey revealed strong support for joining the EU: 78% of Ukrainian citizens are prepared to vote in favor of membership. A consensus appears to be emerging that the EU's next enlargement should occur in 2030, providing sufficient time for candidate countries to meet their obligations. Ukraine is being considered, along with Moldova and Georgia.

Analysis & Forecasting

Although it took less than two years following Ukraine’s initial application, the European Commission’s recommendation for the country’s accession to the EU is likely just the start of a long negotiation process with multiple factors influencing Ukraine’s candidature.

The full-scale invasion and Ukraine’s subsequent dependency on foreign assistance have accelerated the implementation of anti-corruption measures. Although Transparency International ranks Ukraine as the second most corrupt state in Europe and one of the most corrupt in the world, the country continued to improve following the Revolution of Dignity in 2014 and throughout the last decade up until 2022. Ensuring transparency and accountability will be a central step in securing funds for reconstruction.

EU enlargement commissioner Olivér Várhelyi was critical of the law regarding national minorities. In July of this year, the European Commission for Democracy Through Law (Venice Commission) recommended that Ukraine reconsider “limitations of the freedom to use the minority language,” “differentiating between minority languages” and ensuring access to mass media in minority languages by removing quotas. Ukrainian politicians have advocated for the law in an effort to undo the impact of Soviet-era Russification. Hungary and Romania, however, support the Commission’s stance due to Ukraine's significant Hungarian and Romanian minority populations. Their position may affect Ukraine’s accession prospects.

NATO’s reluctance to admit Ukraine amidst ongoing hostilities is another challenge, as most EU states are NATO members and rely heavily on the organization to guarantee their security.

Should Ukraine join the EU, a final issue concerns the EU's projected financial assistance to one of Europe’s poorest countries. According to some assessments, the cost of benefits to which Ukraine will be entitled may be higher than the EU’s annual budget, including nearly one hundred billion euros in agricultural benefits. As it is primarily new EU members that receive significant financial assistance, Ukraine will be competing for this funding with many of its neighbors, a fact that may also affect their support for Ukraine’s accession.

Economy & Development Updates

Inflation, GDP, employment

According to the State Statistics Service, Ukraine’s annual rate of consumer inflation fell from 7.1% in September to 5.3% in October, while prices rose by 0.8%. The Ministry of Economy reported year-on-year GDP growth of 10.5%, and overall growth for the last ten months was 5.5%. This can be attributed to a good harvest, a relatively stable energy sector and the reintroduction of the sea export route.

Favorable weather conditions contributed to high yields. By the end of November, Ukrainian farmers had harvested 77 million tons of crops – a year-on-year increase of 75%, and only 27% less than the record-breaking year of 2021.

The Black Sea corridor was established by Ukraine after Russia withdrew from the Black Sea Grain Initiative (BSGI) in July 2023. By November 24, 153 ships transporting 5.6 million metric tons of grain and other cargo had used the corridor. Judging by the number of ships that sailed in November, the corridor is yielding better results than the BSGI in its final months of operation.

In a less encouraging trend, according to an independent estimate, the unemployment rate rose for the second month in a row, reaching 18.4% in October. The percentage of people forced to economize on food – a standard proxy for poverty – fell to 21.5% in October 2023.

Figure 1. Contributions to GDP: Breakdown of gross value added by economic activity (October, year-on-year change)

Source: Ukraine Ministry of Economy

Analysis & Forecasting

The Ukrainian government has set a budget deficit target for 2024 of ₴1.57 trillion ($43 billion). This figure is likely to be adjusted upward, since by October the 2023 deficit stood at ₴2.1 trillion. As of the end of November, confirmed financial assistance for Ukraine is four times less than what is needed.

The Black Sea corridor is expected to retain its central role in facilitating international trade and supporting economic activity. In addition, in a bid to provide enhanced protection for grain ships in the Black Sea, Ukraine will soon receive warships from its partners. This may increase the risk of Russian attacks on these vessels, however, and further jeopardize the security of commercial shipping. On November 8, a Russian missile struck a Liberian-flagged freighter in the port of Odesa.

Figure 2. Unemployment and the percentage of individuals economizing on food (January 2022 – October 2023)

Source: Info Sapiens

Blockades at the Border

On November 6, Polish truck drivers began a blockade of three of the four largest border crossings with Ukraine. On November 23, the blockade was extended to a checkpoint in Medyka, with farmers joining the truckers’ cause. As of November 29, the blockade was being enforced around the clock with some 2,450 trucks queuing at the border. To compound matters, on December 1, Slovakian hauliers joined their Polish counterparts and announced a blockade at the Vyšné Nemecké border crossing. (For further analysis of the blockade, see the ‘Poland’ section below.)

Consequently, trade with Poland, which is 6-8 times greater than with other neighboring countries, has ground to a halt. Redirecting truck traffic is not a viable option: if all trucks were rerouted to alternative crossings in Slovakia or Hungary, this might result in queues of up to three or four months.

Ukrainian authorities reported numerous instances of fuel tankers and trucks carrying humanitarian aid being forced to wait in line. Although the Polish side had announced it would not block the passage of these categories of goods, long and disorganized queues may make it impossible for them to get through.

The blockade has likely contributed to a 30% increase in the price of liquefied gas in Ukraine, with shortages reported at many gas stations. In November, against the backdrop of rising global oil prices and logistical difficulties, fuel prices were up 9.7% year on year.

A survey by the European Business Association reveals that on average, each missed business day costs a company approximately ₴1 million ($28,000). Less than three weeks into the blockade, the Ukrainian economy had lost more than €400 million. The situation affects both exporters and importers, as certain domestic products also depend on the import of ingredients or packaging materials. The border blockade poses a significant challenge for the retail food industry and is likely to result in shortages and increased prices.

Analysis & Forecasting

If the blockade continues, it may impact prices, push up inflation, and lead to shortages, canceled contracts and potential financial penalties.

Taking a cue from the country’s farmers, Ukrainian businesses are shifting their focus to Romania as an alternative border crossing. The logistical hurdles caused by the blockade are posing significant obstacles for companies competing in EU markets. International aid actors have initiated programs to help businesses expand and reorient toward EU markets, although the blockade represents a real impediment to these efforts. Seen more broadly, the blockade highlights the challenges associated with integrating Ukraine – with its leading agricultural sector – into the EU Single Market.

Humanitarian & Environmental Trends

New legislation about humanitarian aid imports

New government legislation concerning the import of humanitarian aid has sparked controversy within Ukrainian civil society. In contrast to the previous system, which was relatively simple, Ukrainian authorities will, starting on December 1, require electronic declarations along with the submission of reports on how the aid was allocated. The new law encompasses a range of aid categories and will affect both civilian and military assistance.

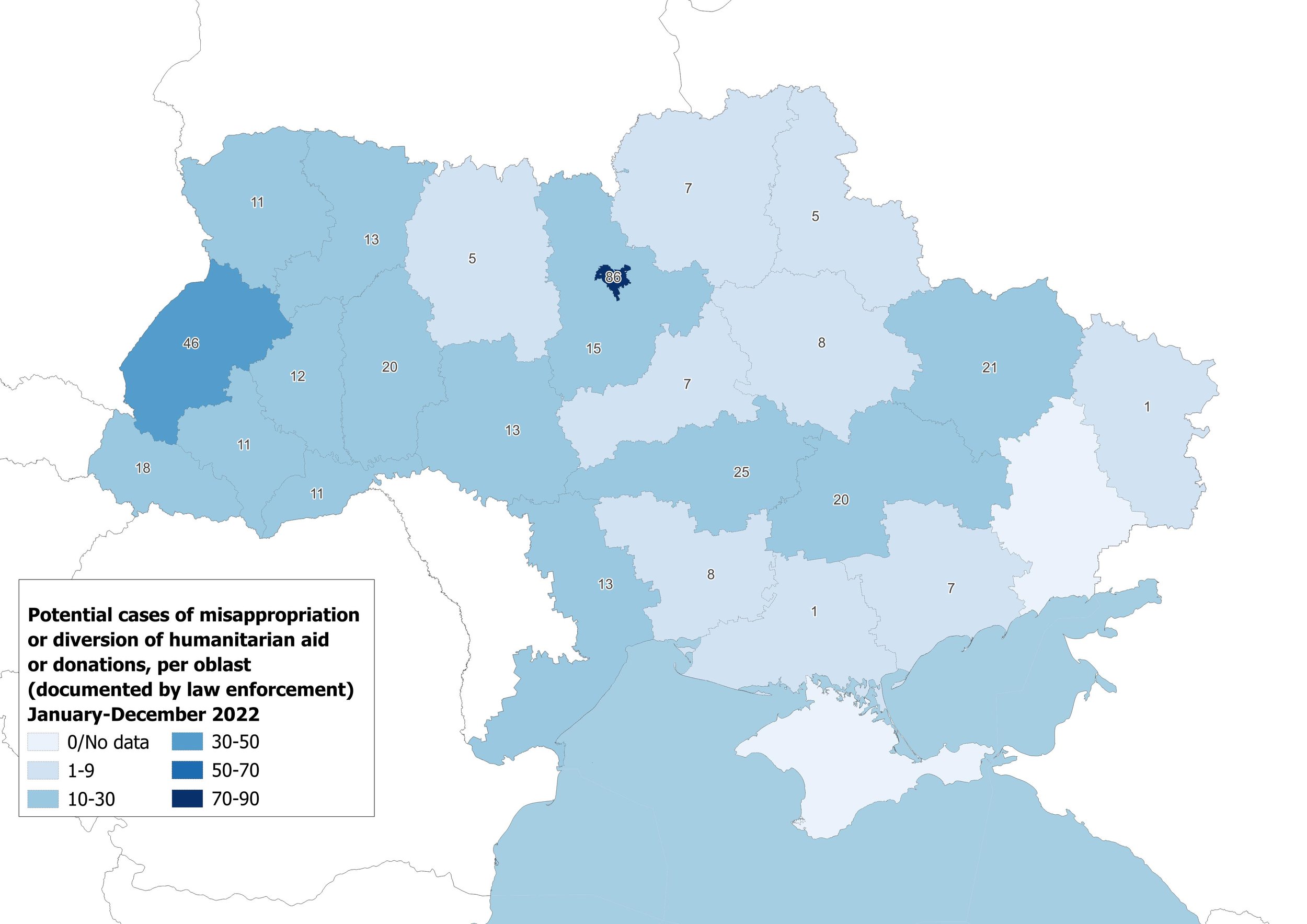

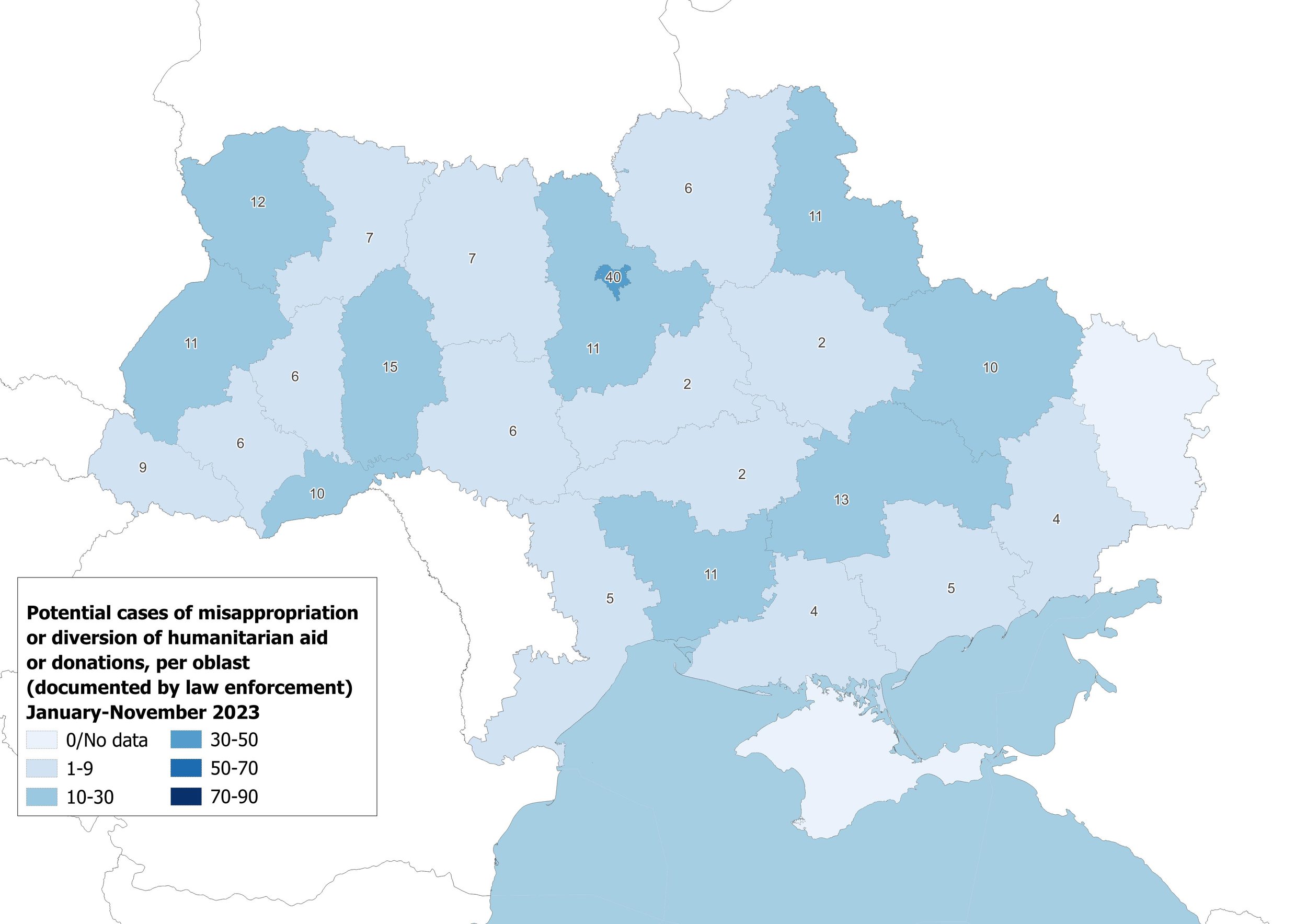

Ukrainian officials say police have investigated hundreds of cases of aid diversion in 2022–23 (see Figure 3). These illicit activities have caused public outrage, particularly when they involved donations collected to support the Ukrainian Armed Forces. Ukraine’s State Customs Service reported that in the first nine months of 2023, roughly one-third of all humanitarian aid designated for approximately 200 Ukrainian military units did not reach its intended destination following customs clearance. According to the Minister of Social Policy, out of 3,000 declarations of aid for military units, the military confirmed receiving assistance in only 800 cases.

Under the new law, for organizations to be granted recipient status by the Ukrainian Ministry of Social Policy, the parties involved in aid distribution must compile detailed inventories and submit aid distribution plans.

After aid has cleared customs, recipients are required to file electronic distribution reports by the 15th of the following month. Failure to do so may result in the withdrawal of recipient status, which can only be re-applied for after a six-month waiting period. The report must contain a list of all final beneficiaries, whether individuals or legal entities, along with their addresses. Failure to submit a report on declared humanitarian aid within 90 days after customs clearance will result in the goods being considered misappropriated. Only certain state-funded entities are exempted from this regulation.

Analysis & Forecasting

Ukrainian NGOs and other aid stakeholders are concerned that the new procedures may complicate aid imports, introduce unnecessary bureaucracy, and fail to curb corruption. They are also worried that the procedures could potentially impede timely humanitarian deliveries to frontline regions, particularly to the armed forces, and that stringent reporting requirements may place excessive time pressures on recipients.

Furthermore, civil society actors are concerned about the security risks associated with the introduction of this new system, which requires that the coordinates of warehouses be entered into a digital system. Given that Russian forces often view humanitarian warehouses as sites containing dual-use goods and therefore legitimate targets, the potential of a data breach poses immense security risks to assistance and aid workers.

While major international organizations possess substantial procurement capabilities and may be less affected by the new law, practical challenges may surface concerning localization efforts by international actors operating in Ukraine. Such procedures could significantly affect the ability of small- to medium-sized organizations to operate effectively and – in the worst-case scenario – force smaller entities out of the humanitarian sphere in Ukraine. INGOs in Ukraine rely heavily on local partners, and particularly their procurement capacities, for aid distribution — especially in areas within 15 km of the front line.

In response, the government has made efforts to accommodate aid actors by extending the adaptation period, allowing paper declarations to be submitted until April 1, 2024. Even this amended procedure, however, is not without complications. The Ministry of Social Policy requires volunteers to use a combination of both systems rather than allowing them to choose one or the other. Consequently, on December 1, frustrated and confused volunteers faced extensive queues at customs controls.

Figure 3. Cases of misappropriation or diversion of humanitarian aid per oblast, 2022 and 2023[1]

Source: Ukraine General Prosecutor’s office as of December 8, 2023

The data does not distinguish between civilian and military aid and suggests that in 2023 there was a significant decrease in cases compared with the previous year. For both years, Kyiv city had the highest number of reported instances, well ahead of the second-worst oblast.

Ukraine's Energy Network Strained To The Limit

Harsh winter weather is already putting Ukraine’s energy grid to the test. On November 27, Ukrainian public broadcaster Suspilne reported that more than 2,000 settlements were deprived of power due to winter storms, and that hostilities had cut off another 500 communities. The impact of the November 26 storm was particularly severe in Odesa Oblast in Ukraine’s southern region, where some 131 settlements temporarily lost access to the grid.

On November 29, adverse weather conditions led UkroEnergo, Ukraine’s transmission system operator, to announce a nationwide energy deficit for the second time in a week. To manage the crisis, emergency assistance was provided by operators in Romania, Slovakia, and Poland.

The energy deficit involved the entire country, affecting even oblasts such as Zakarpattia, which are far from active hostilities. Adding to these weather-related outages, on November 30 the Ministry of Energy reported that over 100 additional settlements in Sumy Oblast remained without power due to a combination of hostilities and technical issues.

Figure 4. Ukraine’s energy production sources in 2023

Ukrainians have been gearing up for severe winter conditions since the spring, in the wake of Russia’s large-scale military campaign to cripple the country's energy infrastructure. From October 2022 to April 2023, Ukraine suffered 1,200 missile and drone attacks on its energy grid. Twenty-two of Ukraine’s 36 power plants were either damaged, destroyed, or rendered inaccessible, while substantial sections of the heating infrastructure in war-torn areas were irreparably damaged. In all, Russia succeeded in disrupting 45 percent of the high-voltage grid and half of Ukraine's energy production. The attacks have also affected major thermal and hydroelectric power stations, resulting in heating outages and water supply cuts.

Throughout last winter, Ukraine relied heavily on its nuclear power plants, and nuclear energy is expected to remain crucial this winter as well. According to Ukrainian authorities, 7 out of 15 reactors are currently operational, with a total of nine that can support the energy grid (Kyiv Independent source).

This fall, several frontline areas have experienced power outages, including Donetsk and Kharkiv oblasts. Kyiv, however, was largely spared until the city was struck by a massive drone attack in mid-November.

Recognizing the difficulties in sourcing spare parts – particularly Soviet-era equipment produced in Russia – Ukraine has made extensive preparations for the coming winter. These include rapid repairs to damaged infrastructure, as well as the strategic implementation of a multi-layered defense mechanism. Equipment has been moved underground, shielded with sandbags, and surrounded by robust structures as a defense against missile and drone attacks. As a result, despite the ongoing hostilities, the country’s energy system has proven to be resilient. On November 28, Prime Minister Denys Shmyhal stated that the latest large-scale drone attack, as well as the adverse meteorological conditions, did not result in consumers being subjected to large-scale energy supply disruptions.

Analysis & Forecasting

The recent massive drone attack on Kyiv on November 24–25 appears to be a prelude to a much broader winter campaign by Russia, which is once again expected to target critical energy facilities. Although Ukraine intercepted all but one of the 75 drones, the assault highlighted the vulnerability of the country’s energy system.

There is concern that Russian forces will step up their attacks as temperatures continue to drop, although they may wait until late December to strike. Analysts have suggested that the November drone attack was principally a reconnaissance mission – an attempt to identify the locations of energy systems while at the same time testing Ukraine's air defense capabilities. Further, Russian forces reportedly began deploying modified drones during this period, in a bid to assess Ukrainian interception rates.

We therefore expect that Russia will eventually deploy high-precision missiles, which they have been stockpiling since this past summer. Despite the robust protection systems that have been introduced, Russia may yet succeed in causing intermittent damage to Ukraine's energy network. On November 27, a Russian attack in a frontline area severely damaged a thermal power plant managed by DTEK, Ukraine’s largest commercial energy operator. This was the fifth such attack on a frontline plant in just over a month.

Ukrainian authorities, however, are better prepared this time. There are approximately 12,000 “points of invincibility” nationwide, with an additional 1,500 available for use if necessary. Additionally, Ukraine imported some 670,000 thousand generators in 2022. For several months now UkroEnergo, in coordination with the Ukrainian authorities and local administrations, have been actively preparing for worst-case scenarios should there be repeated attacks on the country's power facilities.

Neighboring Countries

Poland

November saw significant disruptions at Polish–Ukrainian border crossings due to blockades by Polish lorry drivers and farmers. On November 6, lorry drivers began blocking the Yahodyn–Dorohusk, Rava-Ruska-Hrebenne, and Krakyvets–Korczowa crossings. Only one lorry per hour was allowed to pass, but military and humanitarian supplies were let through. The Polish drivers argued that pre-invasion rules had kept the freight market balanced, but legislation introduced after 2022 has allowed Ukrainian companies to make unlimited trips through Poland. Because of this, Polish firms are losing business due to higher labor costs and the need to comply with stricter EU standards. They are calling for the reinstatement of pre-invasion hauling rules, license audits for new companies, and exemption from Ukraine’s electronic queuing system. Slovak firms joined the protest on December 1 and began blocking the Užhorod–Vyšné Nemecké crossing. Unions from Poland, the Czech Republic, Hungary, Slovakia, and Lithuania are jointly seeking an amendment to the hauling agreement, while at the same time emphasizing that their demands are driven by a desire for a balanced market rather than anti-Ukrainian sentiment.

Polish farmers, who are protesting low grain prices by blocking the Shehyni–Medyka crossing, are demanding continued government support. They argue that growing maize is no longer profitable, particularly given a planned 21% hike in agricultural taxes.

Amidst rising living costs and energy prices, Polish farmers and lorry drivers see similarities between their situations. They point to the EU’s temporary grain import ban, which Poland unilaterally extended. Grain prices are not, however, at an all-time low, and were recently higher than in 2018–2020, contradicting the farmers’ stance.

The situation’s political context is complex. In the runup to Poland’s 2023 October parliamentary elections, almost all domestic political stakeholders sympathized with the farmers. The ruling Law and Justice party, which had positioned itself as a defender of agriculture, faced backlash for its policies and lack of foresight. Allegations of profiteering from grain imports by party-affiliated companies – while the grain was only supposed to transit through Poland – added to the controversy. The opposition, expected to take power in December, also aligned itself with the farmers’ demands.

Recent concessions by the Law and Justice government, including capital loans and subsidies to farmers, appear to be an attempt to put preemptive financial pressure on the incoming opposition government.

Analysis & Forecasting

The blockades highlight economic grievances in Poland, exacerbated by geopolitical factors and EU obligations. Lorry drivers’ and farmers’ protests reflect a struggle to balance national economic interests against broader European policies and commitments.

The outgoing Law and Justice government’s last-minute concessions may be strategic, complicating the incoming administration’s budgetary planning. This might lead to short-term appeasement but could also result in long-term fiscal difficulties. The new government’s response will be critical to set the tone for Poland’s economic and political trajectory, especially concerning its relations with Ukraine. We expect continued negotiations and potential policy reforms, particularly in transport and agriculture.

Moldova

On November 8, the EU adopted its 2023 Enlargement Package, which included a recommendation to open accession talks with Moldova. This was a welcome development for pro-EU elements within the country. Brussels tasked the Moldovan government with further judicial forms and “de-oligarchization” of the country. The European Commission will report on Moldova’s progress in these areas in March 2024. That Moldova has gotten this far this quickly is noteworthy. After securing a parliamentary majority in the 2021 elections, the leadership of the pro-EU Party of Action and Solidarity (PAS) suggested that 2025 – the year its first term ends – would be a realistic timeframe for formally submitting its application for EU membership. In this regard, the announcement represents a significant victory for the ruling party, even if several obstacles must be overcome before Moldova might actually enter the EU.

Chief among these is the question of Transnistria. According to President Sandu, Moldova will, if necessary, begin the process of EU integration without the breakaway region. Expanding on this, Sandu stated, “When people see how the standard of living is rising, how wages and pensions are increasing, how life in our localities is improving, surely they will want to follow the same path too.”

During the month under review, Moldova also witnessed increased tensions between its two major religious institutions. Orthodox priests from at least 13 parishes of the Moldovan Orthodox Church, which is administered by Russian Orthodox church leadership in Moscow, defected to the Romanian-administered Bessarabian Orthodox church out of opposition to the war. From a total of over 1,000 parishes, there have been dozens of such defections since the beginning of the full-scale invasion in February 2022. They come on the heels of a leaked letter, dated September 5, 2023, in which Metropolitan Vladimir, the head of the Moldovan Orthodox Church, complained to Patriarch Kirill, the head of the Russian Orthodox Church, that the church’s staunch and vocal support for the war in Ukraine posed a direct threat to the Moldovan church.

Analysis & Forecasting

In promoting itself to Brussels as an accession-worthy candidate, Moldova seems to have successfully lobbied for the “Cyprus model,” despite not having full control over the country’s territory. This should allow it to focus on critical issues such as judicial reform, corruption and de-oligarchization, areas that the EU wants to see addressed. Although these issues are challenging, if Moldova has indeed been given a pass on Transnistria, its most intractable problem, then its prospects for joining the EU are probably brighter than those of other countries listed in the Enlargement Package. Moreover, unlike Ukraine, Moldova’s small population and economy likely makes it appealing to more risk-averse Member States.

Meanwhile, the church rift warrants continued monitoring. As the Moldovan Orthodox Church serves about 90 percent of the country’s Orthodox parishes, the numbers of defections do not suggest an immediate, large-scale change in the church’s profile. Nevertheless, the one-way direction of the defections is noteworthy. The reaction of the Patriarch in Moscow – and whether pro-war sentiment amongst parishioners is promoted or minimized – will have a significant impact on Moldovan social cohesion, as well as having broader implications for the country’s political climate as its heads into a critical presidential election next year.