Monthly Context Report - May 2023

16 Jun 2023

Cover photo: October 2022, Dnipro, Ukraine.

Artem Kadyhrob (green hat) and his younger brother Maksym (blue hat) play on the playground in front of their family’s temporary apartment. They and their parents, Yevhenii and Anna Kadyhrob, fled from their hometown in April, when their mayor ordered an evacuation of all residents. Since they moved to Dnipro it has been hard for Yevhenii or Anna to find work. The children have had to transition to online learning, which is a challenge for everyone involved.

Summary/Key Themes

Throughout May, the eastern and southern frontlines in Ukraine remained relatively stagnant despite minor Russian and Ukrainian advances. However, there were indications that Ukrainian forces were preparing for a large-scale counteroffensive. Ukraine-linked forces conducted several military operations inside Russia in May, likely to divert Russian forces. Possibly in response to this, a major escalation in Russian strikes on Ukrainian cities and logistics hubs took place, affecting critical infrastructure and causing civilian casualties.

Ukraine’s International partners are scaling up military assistance ahead of an expected Ukrainian counteroffensive. Meanwhile, politicians in neighboring Hungary and Slovakia stand against additional assistance and China getting more involved in conflict negotiations, potentially favoring Russia’s interests.

With several new high-profile cases, Ukrainian authorities continue taking action to battle corruption, at the national and regional levels, including in the judiciary system. Law enforcement bodies investigate hundreds of cases regarding the embezzlement of humanitarian aid.

The decision to terminate tax benefits for small and medium enterprises (SMEs) and resume state inspections and fines from July 1 has been postponed, while a pair of programs intended to provide financial assistance to Ukrainian citizens for property damage incurred during the war began implementation.

The Black Sea Grain Initiative was extended for another 60 days following last-minute negotiations. The politics around recurring renewals continue to threaten the Deal, with negative implications for Ukraine’s economy and global food security. Russia continues to use the extension negotiations to increase leverage on a range of related issues.

In Poland, tensions between the government and the opposition are building up before the parliamentary elections. The controversy has strengthened the center-right opposition, while the far-right, critical of Ukrainian refugees, remains third in polls.

European partners increase financial assistance for Moldova, including for the most vulnerable and the Moldovan army. Social and political tensions continue rising through May due to pro-Russian rallies across the country and the election victory of the pro-Russian party in the Gagauzia region.

Security & Access

Throughout May, the eastern and southern frontlines in Ukraine remained relatively stagnant despite minor Russian and Ukrainian advances. On the ground, Russian assaults in Donetsk Oblast have resulted in limited territorial gains, including the complete capture of Bakhmut city. Nevertheless, Ukrainian forces have launched localized counterattacks against the Russian flanks near Bakhmut, achieving some progress.

There have been indications that Ukrainian forces are preparing for an imminent large-scale offensive now that spring rains have receded and the ground of much of eastern Ukraine has hardened enough not to obstruct major mechanized military movement. Statements from Ukrainian authorities have supported this, as has a major uptick in weapons deliveries. Much speculation exists regarding this counter-offensive’s potential targets and direction. Theories of attacks in multiple directions have emerged, including renewed offensives on eastern fronts in Luhansk and Donetsk and southwards in Zaporizhzhia Oblast, intending to drive towards Melitopol. There has even been speculation of advances across the Dnipro River.

Several military operations took place inside Russia in May, likely to divert Russian forces. On May 22–24, Ukraine-linked military groups entered Russia’s bordering Belgorod Oblast by force and took control over several border settlements, reportedly as deep as 30 km. The governor of Belgorod reported that several civilians had been injured. Previously, similar, but less scale, incidents by the same group, Russian Volunteer Corps (RVC), took place on March 2 and April 6 in the border region of Bryansk. RVC reportedly operates under Ukrainian command inside Ukraine and consists mainly of Russian citizens. The raids are largely understood to have a symbolic value and serve the practical purpose of forcing Russian forces engaged elsewhere in Ukraine to redeploy to secure Russian territory. The raids have raised questions in Western media for Ukraine’s allies, who have made much of their military support contingent on their use in Ukrainian territory.

In May, the number of UAV attacks against military facilities, critical infrastructure and government buildings in Russia and Russian-controlled areas intensified. The notable attacks included a strike on the Kremlin in Moscow on May 3, an attempt to strike Crimea with 22 UAVs on May 7, and over 32 drone strikes against Moscow on May 30.

Analysis & Forecasting

The results of an anticipated Ukrainian counteroffensive will have major implications for the domestic political situation inside Ukraine, the military assistance Kyiv receives, and the war more broadly. A highly successful offensive will increase Ukraine’s leverage in future peace negotiations and guarantee political consensus inside Ukraine. Limited or no success, however, will likely lead to a hardening of frontlines and a war of attrition. That may also increase criticism of the Ukrainian government, jeopardize political stability in the country and further Western military assistance. While the trajectory of the offensive will become clear in the coming weeks or months, humanitarian actors should prepare to respond to several scenarios. First, major shifts in territorial control could improve access to previously inaccessible populations in need of assistance. Secondly, areas returned under Ukrainian control and frontline areas will continue to face major access constraints through a risk of shelling and strikes, as well as UXOs and poorly marked minefields. The high stakes could also see increased strikes on critical infrastructure around the country and in civilian areas.

A major escalation in Russian strikes on major Ukrainian cities and logistics hubs occurred in May. Russia has intensified its airstrikes (predominantly drones and various forms of ground, air and sea-launched missiles), specifically targeting military installations, dual-use facilities, and Ukrainian air defense systems. The attacks have occurred in various locations across Ukraine, causing damage to civilian infrastructure and resulting in civilian casualties. Ukraine’s capital Kyiv alone, was attacked 17 times. Although the air defense demonstrated 90% efficiency and intercepted 254 aerial objects over the city, two people got killed, and 13 were injured. Dnipro is another major city that suffered from multiple attacks. Four people got killed and 34 injured in two attacks on May 22 and 26.

In addition to civilian casualties from Russian drone and missile strikes, multiple casualties have also resulted from Russian shelling near the frontlines. On May 3, Russian forces conducted several indiscriminate artillery strikes targeting civilian and railroad infrastructure in Kherson city and across the oblast. At least 23 civilians were killed and 48 wounded following the shelling. The Kherson railroad station and a passenger train were hit, killing one civilian and injuring six. The previous attack against railroad infrastructure occurred in Kherson city on February 10. The increasing trend of Russian indiscriminate artillery shelling of civilian populations appears ongoing and will likely escalate in the coming weeks in line with broader expected escalations in conflict. This could also result in additional displacement. The Office of the United Nations High Commissioner for Human Rights (OHCHR) verified 174 fatalities and 684 injuries in May, bringing the total number of killed and injured civilians since February 24, 2022, to 8,983 and 15,442, respectively.

During May, Russian strikes directly impacted humanitarian operations, although this doesn’t yet appear to reflect systematic targeting but rather collateral damage. On May 7, a Russian missile hit a mobile hospital operated by Ukrainian Red Cross in Sebyne, Mykolaiv Oblast, forcing it to be removed for rehabilitation. On May 8, a Russian missile strike hit and damaged a large logistics hub near the railroad line in Odesa Oblast. The attack caused a fire, which destroyed the warehouses storing humanitarian aid. The warehouse was used by a Ukrainian humanitarian organization and an INGO, but no humanitarian staff was harmed. On May 13, Russian forces launched a missile strike targeting an industrial area in Ternopil city, damaging a warehouse by a local humanitarian organization, leading to the reported loss of 100 tons of food. On May 23, Toretsk town in Donetsk Oblast was subjected to a Russian airstrike, damaging a school that housed the Point of Invincibility, a facility providing humanitarian aid and support to civilians. Humanitarian organizations should note the increased tempo of Russian strikes near rail infrastructure, industrial facilities, and frontlines.

The graph shows the number of air alarms and recorded explosions in the cities where most international organizations and INGOs are present.

Conflict escalations could have significant human and environmental implications should Russian forces intentionally flood large areas or threaten the functioning of nuclear power plants. Throughout the month, incidents have served as a stark reminder to conflict observers of the significant impact of hostilities on the environment and nuclear safety in Ukraine. In Donetsk Oblast, a Russian artillery strike on May 25 destroyed a dam in the town of Karlivka. Following this attack, numerous communities in the Ukraine-controlled part of the oblast continue to face water shortages. On May 17, there were reports of Russian forces deliberately increasing the water level in the Kakhovka Reservoir on the Dnipro River.

Concerns regarding the water level had been raised months ago, as a decrease in the reservoir’s water level could disrupt the cooling system of the Russian-controlled Zaporizhzhia Nuclear Power Plant (ZNPP). Following Ukrainian sabotage activities targeting the Russian-controlled left bank of Kherson Oblast in mid-April, there is a real risk that Russian forces may continue adjusting the reservoir’s water levels to hinder Ukrainian counteroffensive operations.

Equally concerning is the risk of nuclear incidents at the ZNPP due to shelling, as seen in the Russian attacks on May 22. During this attack, the last remaining external power line to the ZNPP was hit, causing the plant to enter blackout mode for the seventh time since the start of the full-scale invasion. The plant subsequently switched to the Ukrainian energy system on the same day. The previous blackout occurred due to a mass missile strike on March 9. The situation over ZNPP remains a high priority for the U.N.

Analysis & Forecasting

Russian strikes have largely shifted away from critical infrastructure — such as those targeting Ukraine’s electricity grid over the winter — and appear more focused on strategic military sites and headquarters, Ukraine’s air defense, and logistics infrastructure. It is likely linked to efforts to hinder Ukraine’s counter-offensive preparations. Ukraine’s air defenses, however, were resilient during May, and interception rates improved and remained steady throughout the months. It is most likely due to the delivery of various new Western air defense systems, such as Patriot missiles. The tempo of strikes will likely continue into June as Russia attempts to exhaust or degrade Ukraine’s defense while increasing the speed of its domestic production. As of writing, the interception rates have remained high despite high Russian strike levels, indicating Ukraine’s air defenses have remained resilient. Nonetheless, the risk posed by failed interceptions as well as debris from successful interceptions, will continue to result in harm to civilians.

Politics & Governance Updates

In ongoing efforts to solidify international support for Ukraine, high-intensity diplomacy by Ukrainian President Volodymyr Zelenskyi took place throughout May, with a global tour of Europe, the Middle East and Asia. The E.U. reiterated its commitment to supporting Ukraine in the current conflict, with the European Commission President Ursula von der Leyen making a profoundly symbolic visit to Kyiv on May 9 — both Europe Day and Russia’s Victory Day. Major new military assistance packages were also announced in May, as international partners appear to be scaling up military assistance ahead of an expected Ukrainian counteroffensive. The United Kingdom delivered long-range cruise missiles, a major qualitative step forward for the Ukrainian military. Momentum continues to build among a coalition of partners around providing F-16 fighter aircraft to Ukraine.

On May 5, Hungary blocked €500 million ($542 million) from the European Peace Fund intended to support Ukraine’s military and stated its intention to continue to do so. Political uncertainty deepened in Slovakia, another country bordering Ukraine, as the pro-Western prime minister resigned ahead of an election forecast to favor what is considered pro-Russia Direction–Slovak Social Democracy party. Robert Fico, the party leader, has already announced that he would end Slovakia’s arms supply to Ukraine if elected in September. China continues to present itself as a mediator for the conflict, sending an envoy to several European capitals in May to push for a settlement. However, according to international reports, the messaging on a cessation of conflict continues to be highly favorable to Russia’s position and continues to advocate against military material assistance to Ukraine.

Analysis & Forecasting

The re-election of Erdoğan as president on May 28 signals that Turkey will likely continue playing a significant and complex role in the Ukraine conflict. Turkey’s position on Ukraine has several dimensions. While on the one hand, Turkey has provided significant and high-profile support to Ukraine, Erdoğan has maintained strong relations with Putin and has benefited from cheaper access to commodities and favorable economic arrangements with Russia. Erdoğan has also played an important mediator role, notably in the ongoing grain deal allowing Ukrainian exports via the Black Sea and prisoner swaps.

Russia’s paramilitary organization, the Wagner Group, has been recently designated as a “terrorist organization” by the French parliament, and the U.K. is reportedly following suit. The designation has implications for Ukraine and more globally, given the international and destabilizing presence of the armed group in Mali, Burkina Faso and the Central African Republic (CAR). The group has increasingly played a sinister role in several conflict settings around the world. It has been implicated in exploiting national resources and grave human rights violations, including violence against civilians.

Analysis & Forecasting

Aid actors should also consider the security implications of operating in areas with a Wagner presence, given poor discipline and separate command chains from other Russian forces, and be aware of even greater compliance risks should they implement programming funded by sanctioning countries.

Anti-corruption efforts by Ukrainian authorities and high-level corruption cases had a public profile during May. On May 4, the High Anti-Corruption Court issued an arrest warrant against Odesa Mayor Hennadii Trukhanov for embezzlement of public funds. Odesa has historically been a major center for organized crime and corruption in Ukraine. According to the National Anti-Corruption Bureau (NABU), corruption has affected almost all aspects of economic activity in the city. After nearly three months without a governor, the head of the Kyiv City Prosecutor’s Office was appointed to lead the Odesa Regional Administration.

The Ministry of Defense detected significant potential fraud during the chaotic first months of the Russian invasion, especially contracts from March–April 2022, in arms procurement during a recent annual audit, and 30 lawsuits have been opened. Ternopil police are accused of selling donated equipment. During May, corruption allegations impacted the highest level of Ukraine’s judiciary, with the detaining of the head of Ukraine’s Supreme Court, Vsevolod Kniaziev, for taking a $2.7 million bribe to rule in favor of the iron ore oligarch Kostiantyn Zhevaho. Kniaziev is the highest-ranking official arrested for bribery in Ukraine, and other Supreme Court judges are also reportedly being investigated.

Corruption around Estonian NGO Slava Ukraini was the focus of the humanitarian community’s attention. Allegations include several large payments to a former Ukrainian construction company with political linkages and general profiteering. Of note, a Ukrainian whistleblower supporting the Estonian investigation was recently arrested by Dnipro police on charges, he alleges, fabricated to obstruct the investigation. The allegations and investigations have shocked Estonians, with an M.P. linked to the NGO resigning from her position.

According to 2022 data shared by the Prosecutor General’s Office of Ukraine with the UACAT, 458 criminal proceedings were registered regarding humanitarian and charitable aid embezzlement. The most cases were investigated in Kyiv Oblast (112 cases), followed by Lviv Oblast (51 cases); other regions had, on average, around 20 cases. Of these cases, around 74 have been closed, although it is unclear whether these were successfully prosecuted.

Analysis & Forecasting

Due to the history of corruption in Ukraine and the huge scale of military and humanitarian assistance currently being provided to the country through numerous channels, the issue will continue to remain a source of anxiety and significance for the Ukrainian government and society, its international partners and international and local aid implementers. It appears to be matched by trends of increasing capacity among Ukrainian anti-corruption infrastructure. Progress on anticorruption efforts has ramifications for issues as significant as Ukraine’s ambitions to join the European Union. Diversion of military assistance continues to be a major concern among international partners. However, little evidence currently exists that supports this.

The conflict has resulted in a major drive to reduce corruption risks and clamp down on organized crime, as well as efforts to improve the capacity and effectiveness of anticorruption-tasked bodies. It may inversely result in more public scandals and court cases coming to light—which should not be interpreted as a negative trend. In addition, 2023 has seen an erosion of the “code of silence” that was in place during 2022, where reports of corruption—especially as they may have been related to aid or military assistance — were viewed as a major national security threat.

Nonetheless, corruption and the risk of aid diversion will continue to be major risks for aid actors in Ukraine, requiring ongoing attention to in-house risk reduction, political economy analysis, due diligence and compliance capacity. Given the scale of the damage to Ukraine’s economy and the significant amount of financial and in-kind assistance reaching the country, the aid sector will remain a focus for rent-seeking behavior by various actors. Risks around this could increase as recovery and reconstruction efforts gather pace. International partners will closely watch developments in the Ukrainian judiciary and anticorruption efforts more broadly, with progress—or the lack thereof—being heavily linked to assistance levels across various interventions.

Russian authorities continued to force Ukrainian residents of occupied territories to accept Russian passports. It has escalated following a decree issued by Putin in April 2023 emphasizing that those living in recently occupied territories can refuse Russian citizenship but will be considered foreign citizens and will have to leave by July 1, 2024 unless receiving a residency permit. It follows a trend, started in 2014 in Russian-controlled parts of Donetsk and Luhansk oblasts, of gradually increasing exclusion from state services of those not holding Russian citizenship, and will likely continue. Ukrainian authorities sent mixed messages regarding this. While the human rights ombudsman has encouraged Ukrainian citizens in Russian-controlled areas to apply for Russian passports, the deputy prime minister responsible for reintegrating occupied territories asked people not to take Russian passports and avoid collaborating with occupying authorities.

Analysis & Forecasting

Those who refuse the passport, especially on ideological grounds, will likely face increasing exclusion from essential state services and direct limitations on civil rights and freedoms, such as movement, and will seek refuge elsewhere.

Economic & Development Updates

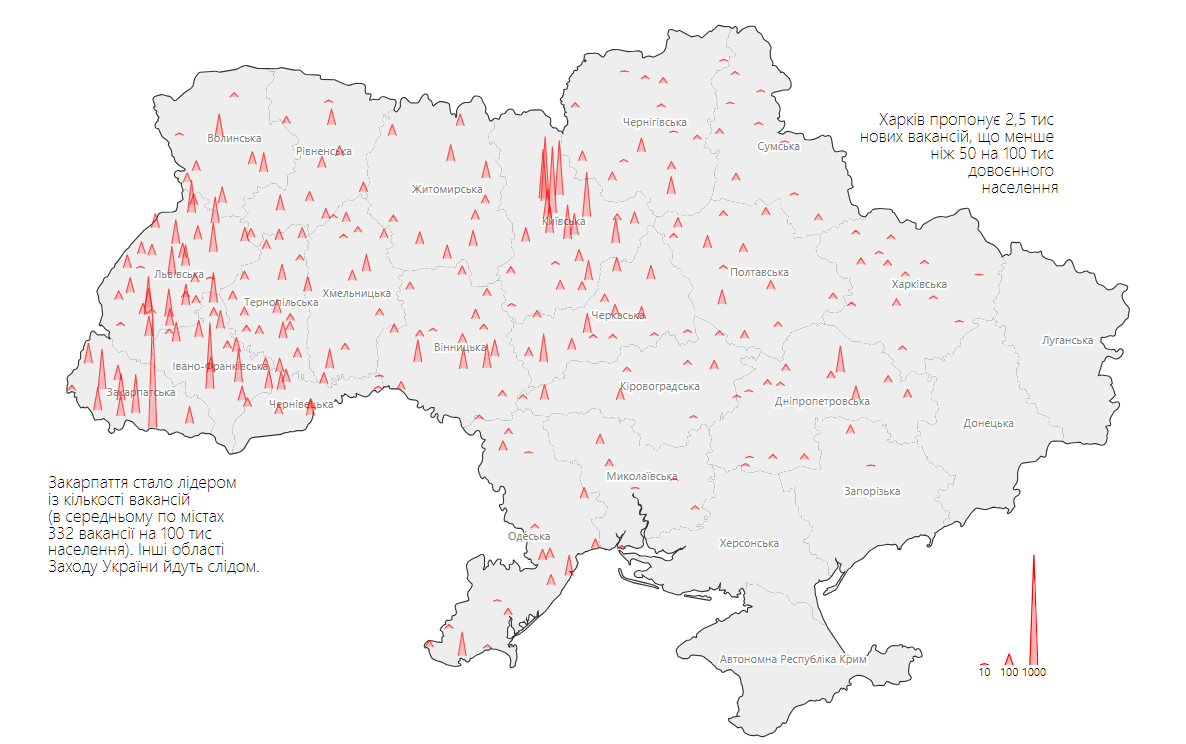

Since the beginning of 2023, the situation in the labor market has been improving. However, unemployment remains high and has acquired structural features. In the first quarter of 2023, the unemployment rate was estimated at 20%. We can also observe geographical disproportionality in the recovery process, as eastern, northern and southern regions are experiencing slower or less effective recovery than other parts of the country. In contrast, Ukraine’s western and some central regions reportedly offer more job vacancies than before the full-scale invasion, as the country’s center of economic activity has shifted from the industrial centers of the east, with the cost of living increasing there as well. Still, most IDPs have settled in Kharkiv and Dnipropetrovsk oblasts, where it is more difficult to find a job given fierce competition and fewer vacancies.

The financial condition of households remains difficult. In 2022, the average nominal salary increased by 6%, but in real terms (inflation-adjusted), it has decreased by 12%. The National Bank of Ukraine (NBU) expects Inflation to stay at 15% during 2023 and GDP growth at 2%.

The satellite imagery illustrates the night light reflectance (NLR) change from January 2021 to January 2023. The tremendous proportional loss in NLR in Kyiv and embattled major cities in eastern Ukraine (e.g., Kharkiv, Dnipro, Zaporizhzhia) show higher levels of NLR in Zakarpattia Oblast and occupied Crimea (likely from new or expanded Russian military installations).

The decision to terminate tax benefits for small and medium enterprises (SMEs) and resume state inspections and fines from July 1 has been postponed. On average, SMEs in Ukraine lost 31.2% of their turnover in 2022 compared to 2021. Three main barriers to business recovery identified by a recent survey were a lack of paying customers, the unpredictability of the development of the situation in Ukraine and the domestic market and unforeseen state actions that could worsen the state of business. Lifting the economic martial law relief measures would inevitably hurt an already vulnerable sector. Business/SME support agencies should note these possible changes and closely follow the current legislative process.

Analysis & Forecasting

Despite some early indications of recovery, international aid actors should continue to expect that a large part of the Ukrainian business community will continue to suffer from the economic contraction driven by the conflict and therefore prioritize market and business-focused interventions which will continue to be of value alongside humanitarian assistance, notably in the most conflict-affected regions of the economy. Vacancy data continues to be a good indicator of the extent to which the conflict has had an unequal economic impact geography-wise. The country’s east, north and south continue to reflect significantly degraded economic activity, which will continue to be the case going forward. Aid actors will continue to see the greatest needs in these areas.

A pair of programs intended to provide financial assistance to Ukrainian citizens for residential property damage incurred during the war began implementation in May. From May 10, the eRecovery program will allow Ukrainian citizens to receive up to ₴200,000 ($5,400) for restoring property that has suffered light to medium damage from the war. Applications should be submitted before the repairs, as the money could be used only for purchasing building materials and ordering repair services. The program does not provide compensation for already repaired housing. Thousands of Ukrainians applied for financial assistance in the first days of the program’s launch. The government allocated the first ₴4.4 billion for the payment of compensation.

Also, in May, the Ukrainian parliament approved a separate compensation program for severely damaged or destroyed property. Starting on May 22 special commission will be organized locally to determine compensation in the form of funds for constructing a new property or as a housing certificate for the property which will be built in the future. Vulnerable categories of people will be prioritized. They include families with three or more children, persons with disabilities, families of fallen Ukrainian soldiers, participants in military actions and persons mobilized after the full-scale invasion.

The Ukrainian Recovery Conference will be held in London on June 21–22. The conference follows last year’s meeting in Lugano, where multiple states pledged to assist Ukrainian reconstruction based on the principles of transparency and sustainability. An online monitoring system is expected to be presented during the conference and will include all reconstruction-related data from ongoing projects.

During May, the Ukrainian parliament enabled greater access to war risk insurance for investments in Ukraine — an important development supporting recovery and reconstruction efforts in the private sector. The new law allows insurance coverage for investments of Ukrainian and foreign companies against war-related risks. The insurance will provide coverage of losses to investors who will build processing or export-oriented enterprises in Ukraine. Rebuilding and modernizing Ukraine’s economy will require significant investment. Current estimates of the cost of reconstruction range from $411 billion to $750 billion. This step is one of many the government will take in its strategy for reviving the economy in partnership with the private sector.

During May, the Black Sea Grain Initiative was extended for another 60 days following last-minute negotiations, and E.U. states increased regulations on Ukrainian overland agricultural exports. Russia had delayed the agreement to remove obstacles to its fertilizer exports and threatened to withdraw from the deal on May 10–11. An agreement was finally reached on the 17th, 24 hours before expiration.

As a result of the port blockade by Russia, a significant portion of Ukraine’s agricultural output has shifted to overland export to the E.U. During May, the European Commission implemented restrictions on Ukrainian overland agricultural exports. Under an ongoing duty-free agreement, Ukrainian products, notably wheat, maize, rapeseed and sunflower seeds, can continue to be sold in E.U. markets, except for Bulgaria, Hungary, Poland, Romania and Slovakia. This follows increasing resentment and mass protests by farmers in these countries towards Ukrainian agricultural imports, which are cheaper, and therefore undercut local production. (For more details, see April Context Update.) To support member states experiencing tensions with domestic agricultural communities, the E.U. has already committed €100 million ($108 million) to support affected farmers. Additionally, on May 23, the E.U. approved €1 billion ($1.1 billion) support for Polish agricultural producers facing liquidity shortages mainly due to increased fertilizer prices. The aid will predominately be direct grants with a max of €250,000 per beneficiary. Despite this, border states continue to impose indirect domestic restrictions on Ukrainian products.

Analysis & Forecasting

The politics around the initiative’s recurring renewal continue to threaten the Black Sea Grain Deal, with negative implications for Ukraine’s economy and global food security. Russia continues using extension negotiations to increase leverage on various related issues. In addition, the disruptive nature of the negotiations themselves negatively impacts the competitiveness of Ukraine’s exports. Throughout May, dozens of ships waited for days before they were allowed to enter Ukrainian ports. These additional demurrage costs affect the prices of doing business and highlight the risk level many businesses continue to associate with importing Ukrainian grains through the Black Sea. Delays and disruptions also affect productivity inside Ukraine, as farmers facing delays in sales and payments struggle to finance additional investments in productivity and new planting seasons. Many consider this gradual erosion of Ukraine’s agricultural export competitiveness intentional on the part of Russia, which has also made efforts to supplant Ukraine’s traditional export markets.

Alternative land export into Europe has its challenges. While the E.U. has extended the duty-free trade regime for Ukrainian exports for another year, the E.U. is aware of the potential problems and unilateral protectionist policies among some member states. E.U. efforts will likely result in ongoing access to most E.U. markets for Ukrainian farmers. However, current and future restrictions on this access will only exacerbate the problems already facing the sector going forward.

Neighboring Countries

Poland

Tensions between the government and the opposition are building up before the parliamentary elections. On May 29, Polish President Andrzej Duda signed a bill creating a committee to investigate Russian influence in Poland. The media dubbed the bill Lex Tusk, as the opposition alleges its real target is the opposition Civic Platform and its leader, former prime minister Donald Tusk’s time in power (2007–2015), and his alleged profiting from the import of Russian coal. The bill, which allows banning individuals from public office for up to ten years without judicial approval, gives the power to make decisions to the prime minister and Sejm, currently controlled by the ruling Law and Justice party.

Observers believe that Law and Justice hoped to benefit from the bill by discrediting the primary opponent ahead of the autumn parliamentary elections. Instead, the widespread criticism of the bill created surprise momentum for the opposition. Many legal experts claimed the body was unconstitutional, and the definition of “Russian influence” was unclear. At the same time, the U.S. expressed concern that the legislation could “interfere with Poland’s free and fair elections.” The European Commission launched an infringement procedure against Poland for violating the E.U. principles of democracy, legality and nonretroactivity of sanctions, the rights to adequate judicial protection and data protection regulations.

Four days after signing the bill, President Duda announced an amended bill limiting some of its powers. The bill is yet to be considered by the Sejm, despite the previous one already being in force.

Analysis & Forecasting

The latest controversy regarding the state of Polish democracy is unlikely to significantly affect the dynamic of Poland’s relations with its Western partners due to its unfettered support and proximity to Ukraine. The West seems to await the results of the autumn parliamentary elections before readjusting their relations with the Polish government. Internally, the controversy has strengthened the center-right opposition, with local commentary focusing on the ruling party’s inability to set the agenda of the public debate for the first time since their rise to power. Given the uncertainty of the elections’ result, the far-right Confederacy party — the only political force critical of Ukrainian refugees — might be instrumental in tipping the scales to either the populist right-wing government or the center-right opposition’s favor at the cost of mainstreaming some of its deregulatory policies.

Moldova

European partners increase financial assistance, including for the most vulnerable and the Moldovan army. The E.U. announced several new economic assistance packages for Moldova, increasing its financial assistance by almost three times, from €600 million ($650 million) initially to €1.6 billion ($1.7 billion). The E.U. also announced a benefit for Moldova’s most vulnerable groups. These pledges come after E.U. High Representative for Foreign Affairs and Security Policy Josep Borrell announced a €40 million ($43.3 million) package under the European Peace Facility framework to enhance the operational effectiveness of the Moldovan army. Western analysts estimate that Moldova would need about $275 million to modernize its outdated armed forces and military equipment of mostly Soviet origin. In addition to these E.U. pledges, Norway promised €50 million ($54.1 million) in assistance, while the U.K. announced £10.5 million ($13.3 million) to support Ukrainian refugees.

Meanwhile, social and political tensions rose in May due to pro-Russian rallies across the country and the run-off election victory of Evghenia Guțul of the pro-Russian Șor Party in the race for governor in Moldova’s autonomous Gagauzia region. The Moldovan government continues to try to counter Moscow’s influence with many elements within the Gagauz community while maintaining a lid on tensions. The Moldovan government is eager to show the European Union that it has an acceptable level of control over the situation within its internationally recognized territory, a condition for membership in the E.U. already challenged by the separatist Transnistria region. Importantly, Borrell signaled that the territorial disputes around Transnistria might not be a dealbreaker for Moldova’s accession to the E.U.

Analysis & Forecasting

It can be expected that the security situation in and around Moldova will remain tense. Russia-backed anti-government rallies are likely to continue, and active Russian destabilization and disinformation campaigns will target the government’s Western political and economic course.

Trends to Watch

The high stakes associated with the Ukrainian counteroffensive and operations inside Russia could see increased strikes on critical infrastructure around the country and in civilian areas. Although Ukraine has significantly improved its air defense capabilities and the interception rates have remained high, the risk posed by failed interceptions and debris from successful interceptions will continue to harm civilians. Shifts in territorial control due to a successful Ukrainian counteroffensive could improve access to previously inaccessible populations needing assistance, although some major access constraints will remain. Limited or no success, however, will likely lead to a hardening of frontlines and a war of attrition, increased criticism of the Ukrainian government and jeopardizing political stability in the country and further Western military assistance.

Kyiv’s international partners will likely continue long-term support. However, the scale of military assistance might depend on the results of the current counteroffensive campaign. In contrast, reconstruction assistance and integration with the E.U. are subject to domestic reforms and addressing corruption. With the recent re-election of Turkish President Erdoğan and Chinese President Xi Jinping, Ankara and Beijing will likely play even more active roles in the Ukrainian crisis. Considering both countries maintain constructive relations with Kyiv and Moscow, their negotiation initiatives may become more active and bring some results, especially after the active stage of the Ukrainian counteroffensive.

Given the scale of the damage to Ukraine’s economy, and the significant amount of financial and in-kind assistance reaching the country, the aid sector could remain a focus for rent-seeking behavior by various actors.

With The Grain Initiative under the constant threat of non-extension, alternative land export into Europe is critical for Ukrainian producers. Still, it has challenges, including unilateral protectionist policies among some E.U. member states. E.U. efforts will likely result in ongoing access to most E.U. markets for Ukrainian farmers. However, current and future restrictions on this access will only exacerbate the problems already facing the sector in the future.

It can be expected that the security situation in and around Moldova will remain tense. Russia-backed anti-government rallies are likely to continue, and active Russian destabilization and disinformation campaigns will target the government’s Western political and economic course.